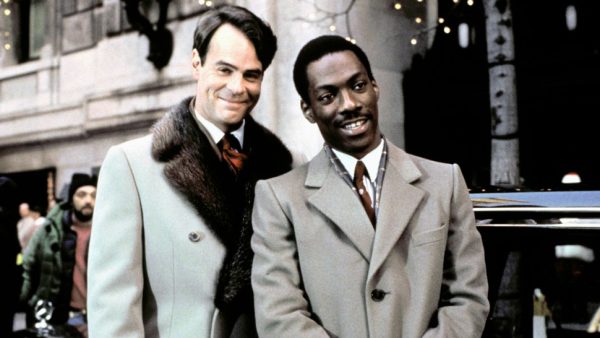

Credit : Paramount / imdb

Director : Adam McKay

Writers : Charles Randolph, Adam McKay, Michael Lewis

Stars: Christian Bale, Steve Carell, Ryan Gosling

Storyline

The U.S. mortgage housing crisis of 2005 is told through three parallel stories. Michael Burry, a quirky hedge fund manager, believes the housing market is a bubble that will burst. He bets against the market with banks who think he’s crazy. Jared Vennett from Deutschebank catches wind of Burry’s plan and wants to profit from it. Mark Baum, tired of corruption in finance, joins forces with Vennett, despite mistrust. They believe mortgages are overrated and banks package sub-prime mortgages as top-rated. Charlie Geller and Jamie Shipley, small-time investors, want in on the action. They enlist retired banker Ben Rickert for help. All groups think the banks are clueless, but winning means harming the general economy and trusting investors. Baum struggles with this. Their assumptions may be wrong and the situation more manipulative than expected.

Plot

A group of investors in 2006-2007 bet against the flawed and corrupt United States mortgage market. Three parallel stories unfold during the 2005 U.S. mortgage housing crisis. Michael Burry, a unique hedge fund manager, believes a housing market bubble will burst. He bets against the market with confident banks. Jared Vennett, an investor, seizes the opportunity and involves Mark Baum, an idealistic critic of financial corruption. Charlie Geller and Jamie Shipley, small players in a startup, want in on the action and seek help from retired banker Ben Rickert. All believe banks are unaware, but winning means harming trusting investors and the economy. Assumptions may be wrong and manipulations more complex than imagined.

The big short, Credit – Paramount / imdb

Synopsis

Ryan Gosling’s character, Jared Vennett, tells us that banking is usually pretty boring. Things changed, however, when Lewis Ranieri, played by Rudy Eisenzopf, devised a strategy to make mortgage-backed securities more profitable and less dangerous. This piqued the interest of bankers until the global financial crisis struck in 2008. Vennett says that a small handful of people predicted this calamity.

The next scene shows Michael Burry, played by Christian Bale, interviewing a young analyst in his office. Burry discusses his glass eye, which he has had since childhood. He tells how he was ashamed when his eye fell out during a football game. Burry then discusses how the tech bubble crashed in 2001, while the housing market survived.

In another scene, Steve Carell’s character, Mark Baum, enters a counselling session and takes over the conversation, complaining about a retail banker who takes advantage of working people. Baum despises people who work for large banks because his brother committed himself after being mistreated. He expresses his displeasure to his wife and contemplates quitting his work. Baum then hails a taxi and exits.

Burry investigates the list he requested and discovers that subprime loans, which have higher risks and lower returns, are supporting the housing market. He plans to earn a profit by betting against the property market. He visits numerous institutions, beginning with Goldman Sachs, to persuade them that the bonds will fail.Vennett learns about Burry’s actions and meets with Baum and his team of investors to propose the idea of credit default swaps. He explains that bad bonds can be grouped into Collateralized Debt Obligations (CDOs). Vennett uses a metaphor of making a seafood stew with unsold fish to explain CDOs. After Vennett leaves, Baum and his team consider taking his advice seriously.

We meet Charlie Geller and Jamie Shipley, two young investors played by John Magaro and Finn Wittrock, who are attempting to meet with someone from JP Morgan Chase. However, companies encounter challenges due to the lack of an ISDA agreement. Disappointed, they come upon Vennett’s presentation on the housing market bubble. Because they lack experience, they decide to join the credit default swap trend and recruit the assistance of retired trader Ben Rickert, played by Brad Pitt.

Moses and Collins, played by Rafe Spall and Hamish Linklater, go to a repossessed property in a neighbourhood. They meet a renter who is afraid of being evicted with his son. They break into homes with past-due notices and even discover an alligator in a pool.

Burry’s supervisor confronts him about his wagers, and several investors demand their money back. Burry, on the other hand, refuses to give in.

Baum and his colleagues continue to investigate the housing market. They speak with a real estate agent, mortgage brokers, and even a stripper to learn about the different types of loans available to customers. Baum recognises that the market is, in fact, a bubble.

Mortgage delinquencies reach a new peak in early 2007. Risk assessors advise Baum and his colleagues to cancel their swaps, but Baum refuses. They visit with Georgia Hale, a Standard & Poor’s officer, and question her about assigning AAA ratings to subprime loans. Baum criticises her, but she counters by pointing out that his team also has credit default swaps.

Due to rising mortgage defaults, Vennett recommends Baum and his team to exit their transactions, and Geller advises Shipley to do the same. However, they both express negative opinions. Rickert tells them that the market will eventually collapse, affecting millions of individuals. For Geller and Shipley, reality sets in.

Baum encounters Mr. Chau, a businessman who exposes the invention of synthetic CDOs, which are increasingly dangerous bets on defective loans. Baum eventually realises that the economy is on the verge of collapsing. Richard Thaler and Selena Gomez appear to explain the notion of synthetic CDOs using a blackjack analogy.

By April 2007, everyone is bracing for the impending collapse. Burry stops investors from withdrawing their funds. Geller and Shipley attempt to alert the press, but no one listens.

As expected, the market falls by the end of 2008, and those participating in swaps shorting make substantial profits. Several banks close their doors. Burry retires, and one of his analysts works at a 7-11. Moses and Collins previously visited a man who is now living in a vehicle with his family. Geller and Shipley have lost trust in the system. Baum suggests a bailout, and Daniel suggests selling their swaps, but Baum believes this would make them just as terrible as the banks. He eventually decides to sell all of them.

The final document indicates that trillions of dollars have vanished, millions of people have lost their jobs and homes, and banks have blamed the problem on immigrants, the poor, and teachers. Mark Baum refused to say “I told you so,” and his fund is still in operation. Geller and Shipley attempted but failed to sue rating agencies. Shipley continues to oversee Brownfield, but Geller has relocated to Charlotte to start a family. Rickert and his wife live on an orchard and exclusively invest in water. Large banks began selling billions of dollars in CDOs in 2015, proving that they had not learned from their failures.