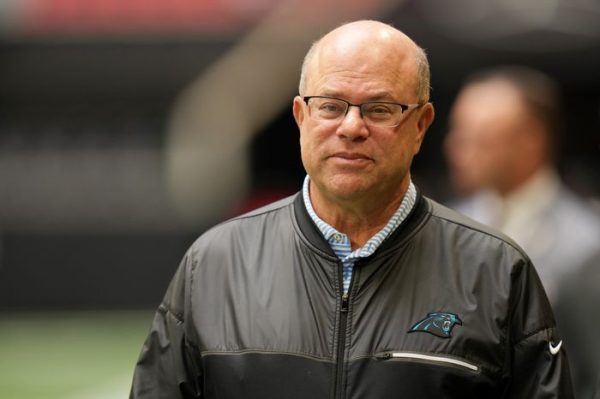

David Tepper, an exceptional American billionaire hedge fund manager, has not only made a name for himself in the financial industry but has also gained recognition as the proud owner of the Carolina Panthers, a renowned team in the National Football League (NFL).

As the founder and president of Appaloosa Management, a global hedge fund based in Miami Beach, Florida, Tepper has demonstrated remarkable expertise in investment strategies and has achieved remarkable success throughout his career.

Early Life and Education: A Foundation for Success

David Tepper, who was born in Pittsburgh, Pennsylvania, on September 11, 1957, was raised by a Jewish family in the East End area of Stanton Heights. His parents, Harry and Roberta, gave him a supportive environment in which he was encouraged to follow his passions and hone his skills. Tepper showed an early interest in sports, especially football, and early evidence of his remarkable memory when he recalled baseball statistics from cards his grandfather had given him.

Tepper was a National Merit Scholar while he was a student at Pittsburgh’s Peabody High School, where he excelled academically. He began his academic career at the University of Pittsburgh after graduating from high school, where he eventually earned a bachelor’s degree in economics in 1978. Tepper went on to earn an MBA from Carnegie Mellon University in 1982 after realizing the value of continuing his education. This enhanced his understanding and proficiency in the field of finance.

Family and Personal Life

While David Tepper’s professional endeavors have garnered significant attention, he remains a private individual who prefers to keep his personal life out of the public eye. Tepper is happily married to Nicole Tepper, and together, they have three children named Brian, Casey, and Randi. Despite his reserved nature, Tepper’s impact on the financial world and his dedication to philanthropy speak volumes about his character and commitment to making a difference.

Building a Strong Foundation

After earning his MBA from Carnegie Mellon and gaining a solid understanding of economics, David Tepper started his career as a credit analyst at Equibank. He joined Republic Steel’s finance department in 1984, where he developed crucial knowledge in distressed investing. Tepper joined Goldman Sachs’s newly established junk bond department in 1985, though, and his career really took off after that. He rose quickly to a key position inside the company.

The Rise of a Hedge Fund Powerhouse

David Tepper decided to leave Goldman Sachs in 1993 to start his own hedge fund, Appaloosa Management, as a result of his unmatched competence and entrepreneurial zeal. The fund flourished and quickly acquired prominence under his skilled supervision. By the turn of the 2000, Appaloosa Management had over $1 billion in assets under management, solidifying its position as a major player in the financial sector.

Tepper’s investment approach focused on distressed debt, and he had a remarkable aptitude for spotting undervalued assets during difficult economic times and frequently capitalizing on them to make substantial returns. Tepper successfully navigated market volatility by savvy decision-making and rigorous analysis, earning his reputation as one of the most knowledgeable investors of his generation.

Wealth and Philanthropy: David Tepper net worth

David Tepper’s wealth has increased significantly over time; in 2023, it is predicted that he would have a net worth of over $18 billion. Due to his extraordinary success, Tepper has developed into a well-known philanthropist who donates millions of dollars to numerous charity organizations. Tepper’s philanthropy has allowed institutions like Carnegie Mellon University, the University of Pittsburgh, and the Robin Hood Foundation to expand their goals and have a good influence on communities.

Diversifying and Expanding Horizons

Beyond his imposing position in the hedge fund sector, David Tepper has started a number of businesses that have increased his power and widened his reach. Notably, he has made investments in well-known sports organizations like the New York Mets, Charlotte FC, and the Carolina Panthers. Tepper also owns a large portion of the renowned Heinz Ketchup Company, demonstrating his breadth of economic interests and his aptitude for spotting lucrative investment opportunities.

Investments: A Bold and Calculated Approach

David Tepper is known for his fearlessness and willingness to take calculated risks when investing. He has made a number of significant and wise investment choices over his career that have generated sizable profits. His huge wager against the subprime mortgage market in 2008, which turned out to be quite profitable, is a prime example. Tepper has constantly stood out among his colleagues due to his aptitude for analyzing market trends and spotting lucrative possibilities.

A Visionary Leader and Philanthropist

David Tepper’s impact on the financial industry, coupled with his remarkable success as a hedge fund manager and business leader, is undeniable. His entrepreneurial spirit, strategic decision-making, and exceptional investment acumen have catapulted him to the pinnacle of the financial world. Moreover, his commitment to philanthropy and generosity in giving back to society highlight his character and commitment to making a positive difference in the lives of others.