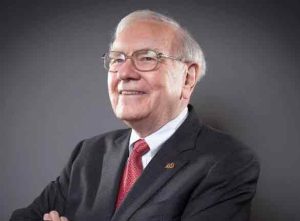

Renowned investor and billionaire Warren Buffett recently shared his concerns regarding the ongoing debt ceiling crisis and its potential impact on the US economy. In a statement, Buffett emphasized the importance of addressing the government’s borrowing limit to avoid a potential default.

This article delves into Buffett’s warnings and sheds light on the implications of a government default on the economy and financial markets.

Buffett's Warning

Warren Buffett, the chairman and CEO of Berkshire Hathaway, is known for his successful investment strategies and astute financial insights. His recent warning about the debt ceiling crisis carries significant weight. Buffett highlighted the risks associated with a default and urged Congress to take prompt action to raise the borrowing limit. He stressed that failure to do so could have severe consequences for the US economy and financial markets.

The Debt Ceiling Crisis

The debt ceiling, or the statutory debt limit, is the maximum amount of money that the US government can borrow to fund its operations. Once the debt ceiling is reached, the government faces the risk of defaulting on its obligations, including paying its bills, servicing its debts, and meeting its financial commitments.

Implications of Default

A government default would have far-reaching implications for the US economy and global financial markets. Here are some potential consequences:

Credit Rating Downgrade: One of the immediate consequences of a default would likely be a downgrade in the US government’s credit rating. Credit rating agencies assess the creditworthiness of countries, and a default would signal a significant deterioration in the government’s ability to meet its financial obligations. A credit rating downgrade would lead to higher borrowing costs, negatively impacting the government, businesses, and consumers alike.

Market Volatility: A default would trigger widespread market volatility and uncertainty. Investors would become increasingly risk-averse, leading to a decline in investor confidence. Stock markets would likely experience significant declines, potentially resulting in substantial financial losses for investors and pension funds. The uncertainty surrounding a default could also extend to other financial markets, such as bonds and commodities.

Increased Borrowing Costs: In the aftermath of a default, the US government would face higher borrowing costs. Investors would demand higher interest rates to compensate for the increased risk associated with lending to the government. The higher borrowing costs would strain the government’s budget, diverting funds from essential public services, infrastructure projects, and social programs.

Damage to Global Reputation: The US has long been regarded as a safe haven for investors and a pillar of stability in global financial markets. A default would severely damage the country’s reputation and erode trust in the US dollar as the global reserve currency. This could lead to a loss of confidence in the US economy and could potentially result in a decline in foreign investments.

Buffett's Call to Action

Warren Buffett’s warning carries weight due to his vast experience and track record in the financial world. He called on Congress to set aside political differences and act swiftly to raise the debt ceiling. Buffett stressed that fulfilling the government’s financial obligations is crucial to maintaining stability and instilling confidence in the economy. He highlighted the need for a bipartisan solution that ensures the government can continue meeting its obligations and avoids a default.

Warren Buffett’s warning about the debt ceiling crisis serves as a timely reminder of the potential risks and far-reaching implications of a government default. The US economy and global financial markets heavily rely on the stability and reliability of the US government’s financial commitments. It is imperative for policymakers to come together, rise above partisan politics, and find a solution that raises the debt ceiling, ensures the government’s ability to meet its obligations, and safeguards the overall economic well-being of the nation and its citizens. Failure to address the debt ceiling crisis could have severe consequences for the US economy and financial